The stock price of Pacific Biosciences of California (NASDAQ: PACB) a biotechnology company that develops gene sequencing systems, has seen a solid 27% rise over the last ten trading days, though it’s down 4% over the last five trading days, and we believe the stock may continue to trend higher in the near term. The recent rise can largely be attributed to the recently announced Softbank investment of $900 million in the company. Note that Softbank already held a 6% stake in Pacific Biosciences prior to this new offering in the form of convertible senior notes. Now, PACB stock was already doing great with a massive 12x rally from levels of under $3 in March 2020 to over $34 in early February 2021, due to its sequencing for the coronavirus genome. The company’s key product - Sequel system - is a nucleic acid sequencing platform based on Single Molecule, Real-Time Sequencing technology. The company has been focused on increasing its installed base, which currently stands at 203. With more systems being installed, the company can look forward to recurring consumable revenues going forward. Since early February, PACB stock has now rallied to levels of over $44.

Looking at the recent rally, the 25% rise for PACB stock over the last 10 days compares with just 3% gains seen in the broader S&P 500 index. Now, is PACB stock poised to gain further? It appears so. Given the current momentum in the stock, and based on our machine learning analysis of trends in the stock price over the last few years, we believe that there is a 58% chance of a rise in PACB stock over the next month (twenty-one trading days). See our analysis on Pacific Biosciences of California Stock Chances of Rise for more details. Curious about the possibility of rising over the next quarter? Check out the PACB Stock AI Dashboard: Chances Of Rise And Fall for a variety of scenarios on how PACB stock could move.

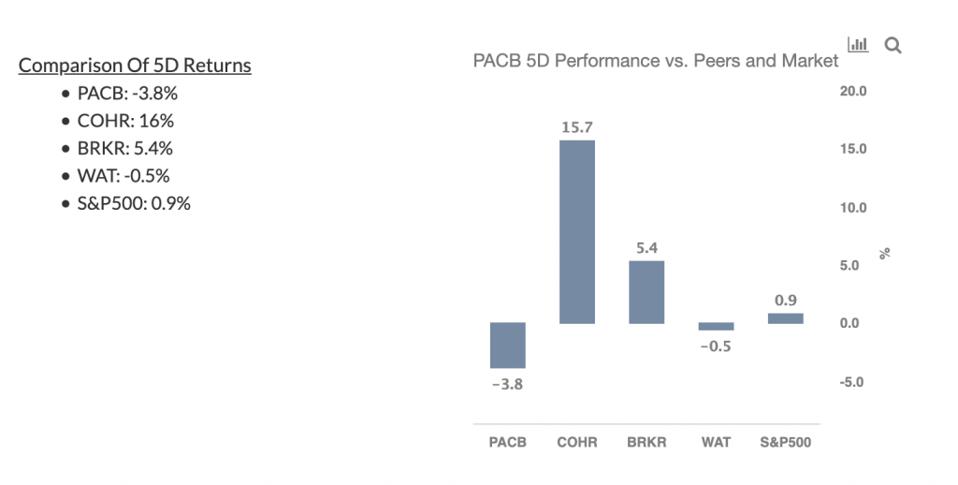

Five Days: PACB -3.8%, vs. S&P500 0.9%; Underperformed market

(26% likelihood event)

- Pacific Biosciences of California stock declined 3.8% over a 5-day trading period ending 2/18/2021, compared to broader market (S&P500) rise of 0.9%

- A change of -3.8% or more over 5 trading days is a 26% likelihood event, which has occurred 329 times out of 1256 in the last 5 years

Ten Days: PACB 27%, vs. S&P500 3%; Outperformed market

(28% likelihood event)

- Pacific Biosciences of California stock rose 27% over the last 10 trading days (2 weeks), compared to broader market (S&P500) rise of 3.0%

- A change of 27% or more over 10 trading days is a 28% likelihood event, which has occurred 352 times out of 1240 in the last 5 years

While PACB stock may gain more, 2020 has created many pricing discontinuities which can offer attractive trading opportunities. For example, you’ll be surprised how counter-intuitive the stock valuation is for Pfizer vs Merck.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

"last" - Google News

February 19, 2021 at 06:30PM

https://ift.tt/3k3lrPm

Pacific Biosciences Stock May Continue To Rally After 27% Gains In Last 10 Days - Forbes

"last" - Google News

https://ift.tt/2rbmsh7

https://ift.tt/2Wq6qvt

Bagikan Berita Ini

0 Response to "Pacific Biosciences Stock May Continue To Rally After 27% Gains In Last 10 Days - Forbes"

Post a Comment